InMotion Ventures has participated in a $33M Series B round for ev.energy. The round was led by National Grid Partners with participation from Aviva Ventures, WEX Venture Capital and existing investors Energy Impact Partners, Future Energy Ventures and ArcTern Ventures.

Louis Fearn, Principal at InMotion Ventures, explores why we invested.

The market

Electric vehicles (EVs) will account for half of global car sales by 2035 (1). With OEMs announcing all-electric lines at scale, and the US expected to be home to 28 million private chargers by 2030 (2), EV charger stock is on the rise. All indicators point towards a substantial target market for new technologies across the charging value chain.

There can be no denying that mass electrification is critical to the clean energy transition. Yet modern power demands come with an unprecedented challenge: the grid as we know it was not designed to accommodate millions of electric vehicles.

Gretchen Bakke noted the complex and pressing task of grid reformation in her 2016 book, ‘The Grid: The Fraying Wires Between Americans and Our Energy Future’. Bakke explained “that transitioning America away from a reliance on fossil fuels and toward more sustainable energy solutions will be possible only with a serious re-imagination of our grid.” In other words “the more we invest in “green” energy, the more fragile our grid becomes.”

We cannot understate the risk to our energy systems, however with every challenge comes an opportunity. Take, for example, the recent power outages caused by grid constraints in California: a state expected to have nearly 8 million EVs on its roads by the end of the decade. EVs that support bidirectional charging have the capacity to power entire homes for a day. Drawing power from the grid at off-peak times and transmitting to external devices when demand is high. In an area where blackouts are becoming the norm, bidirectional EVs can double up as a valuable power source. To put the scale of this opportunity in perspective California’s EV capacity by 2030 will amount to approximately 80 gigawatt-hours of power (3).

What ev.energy does

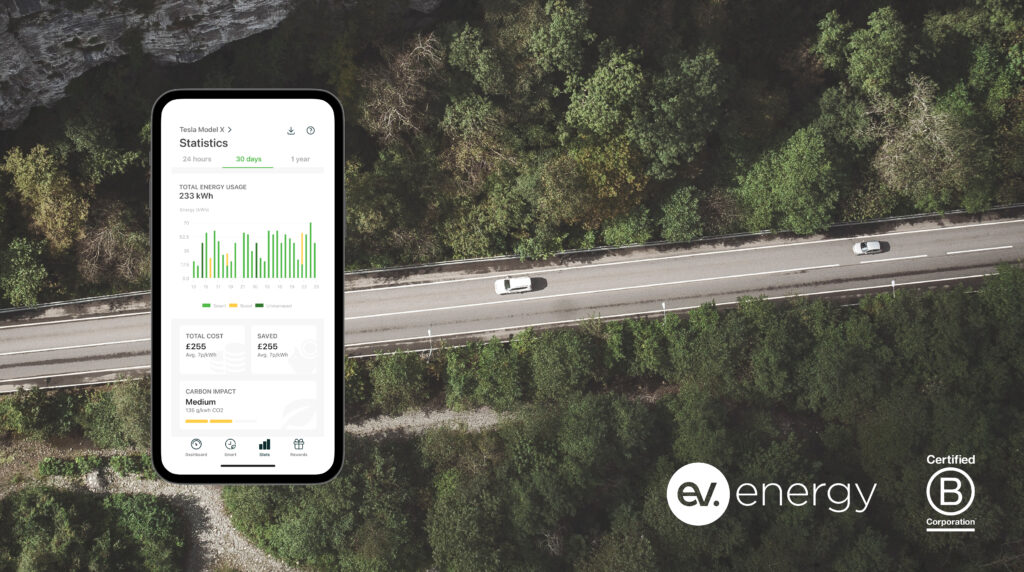

When considering these challenges it becomes clear that technologies that reduce the impact of modern grid demands will be instrumental in tackling the systems-level problems that exist. ev.energy, based in London and founded in 2018, seamlessly connects electric vehicles to grid networks to make charging simpler, greener and cheaper. Their end-to-end platform intelligently manages the power requirements of EVs by charging vehicles at grid-friendly times based on a multitude of factors, including grid capacity.

The company takes a holistic approach to grid reformation, understanding that success and long-term impact depends on integration with the entire value chain – from energy utilities to OEMs and charging providers. The end-result is a software platform that has become the cornerstone of vehicle-grid integration globally. One that enables EV owners to manage their power usage with ease whilst negating the need for utilities to invest in expensive infrastructure upgrades.

Why we invested

ev.energy have the most comprehensive experience of enabling access to flexibility markets globally. The UK-based startup is on track to capture close to 70% of value across the charging services value chain, with a strategy that has positioned the business firmly at the forefront of an increasingly competitive sector.

The team’s product-first mindset is unrivalled. Their commercially operational Virtual Power Plant was bolstered by the launch of a trading demand response platform in 2021, and this fresh injection of Series B capital will accelerate the rollout of their Vehicle-to-Grid (V2G) solutions, fleet management platform ‘Pando ‘and solar home charging function, ev.energy SOLAR.

A software-only approach underpins ev.energy’s roadmap, enabling rapid scale irrespective of geography: as demonstrated in their UK, European, Australian, and US operations. As a result, ev.energy have gained a distinct advantage over hardware solution providers who find themselves at the mercy of complex supply chain logistics and geopolitics.

Despite being founded five years ago, the team – led by founder Nick Woolley – have established a significant footprint in most major markets. The business is enjoying a period of impressive and sustained growth, serving over 120,000 drivers daily and growing at a rate of 1,500 drivers per week. The now 90+ strong team have successfully built and scaled partnerships with over 40 energy and hardware brands, including National Grid, Maxeon, and Siemens. Impressive traction given the deep complexities surrounding charging and historically disjointed approaches to grid reformation.

Congratulations to ev.energy for raising a substantial Series B from an impressive consortium of investors. This round will facilitate their North American and European expansion and create pathways between their Virtual Power Plant and millions of vehicles, chargers, and drivers. We look forward to supporting Nick and the team in this exciting next phase.

We’re always interested in speaking with exceptional founders setting new benchmarks in quality, technology and sustainability. If you are a founder, or know a company in the space, please do get in touch with the InMotion Ventures team, either via LinkedIn or through our investment form.

______________________________________________________________________________________________

Footnotes: